Table of Content

- How much tax will I owe N.J. when I sell my home?

- Do I Need to Pay Tax on Selling a Home?

- Do I pay property tax when I sell my house?

- Better real estate agents at a better rate

- Selling Investment Real Estate in New Jersey? Beware of the “Exit Tax”

- Who pays transfer taxes in New Jersey: the buyer or the seller?

- Talk to one of our Rumson NJ Real Estate Attorneys to Craft an Action Plan for Selling your Home as an Out-of-State Resident

This fee is considered a tax filing, and as such, the seller does not receive any part of the fee back unless they have overpaid the required state tax. Gross income is the total amount of your earned and unearned income that is considered taxable by the Internal Revenue Service and is not initially exempt from taxation according to the Internal Revenue Code. When a person sells a home in New Jersey, the sale obviously becomes part of the person’s gross income. The seller/grantor must fill out the appropriate GIT/REP form based on his/her/their residency status. All nonresident estates and trusts are required to check the box indicating NJ-1041.

If you converted a rental property into your primary residence, your basis would be the lower of your original purchase price or the fair market value of the home on the date you converted its use. You will still increase the basis by any money spent on improvements. Based on all of this, the entire $100,000 gain would be subject to income tax for both federal and New Jersey tax purposes, Hook said. He said the state requires all real property owners to execute a special tax form that must be attached to all deeds upon the sale of the property. The seller/grantor must attach a copy of a completed W-7 TIN application form to the GIT/REP-1 form to be submitted with the deed for recording with the appropriate county clerk. Connect with our concierge team to get paired with a top agent that knows the ins and outs of your local transfer taxes — all for a low 1% listing fee.

How much tax will I owe N.J. when I sell my home?

It’s the greater of 8.97 percent of the profit on the sale of the home or 2 percent of the selling price, said Gerard Papetti, a certified financial planner and certified public accountant with U.S. Are you selling your house in New Jersey and are not a resident of the state? We have years of experience supporting non-residents in obtaining the best deal on the sale of their homes and navigating the New Jersey taxation system. We help clients successfully sell their homes in Colts Neck, Middletown, Rumson, Point Pleasant, Little Silver, and across the Jersey Shore. At The Law Office of Chamlin, Uliano & Walsh, we know that the nitty-gritty details of getting a great deal on your house while abiding by New Jersey real estate and tax law can be daunting, and we’re here for you.

A resident/nonresident corporation, partnership, or multi-member LLC is required to complete and sign the GIT/REP-3 form (Seller's Residency Certification/Exemption). Check box #5 under seller assurances (Seller is not an individual, estate, or trust. . .). So if your net proceeds are $270,000 and your cost basis is $250,000, you’ll be responsible for capital gains taxes on $20,000 of profit. At the 15% capital gains tax rate, you’ll owe $3,000 in the year you sold the home. If you don’t qualify for the tax exclusion above, consider one of the other special considerations the IRS allows for when calculating capital gains taxes.

Do I Need to Pay Tax on Selling a Home?

The sale of a non-primary residence isn’t eligible for the exclusion and will be taxed at capital gain rates, he said. That would be based on the difference between the selling price and the cost of the property, factoring in home improvements and less depreciation, if taken, he said. A 1031 exchange allows you to roll over profits from a second home sale into another investment property within 90 days of selling and defer capital gains tax liability. This is a complicated process that requires an intermediary to manage the rollover, and you’re required to follow specific guidelines.

If you won’t qualify for any capital gains tax exemptions, it’s best to know how much you’ll owe ahead of time so you have a better idea of your final profit. When you buy items or services in New Jersey, you generally pay Sales Tax on each purchase. The seller (a store, service provider, restaurant, etc.) collects tax at the time of the sale and sends it to the State. When buying, selling, or transferring real property in New Jersey, taxpayers should be aware of certain taxes, fees, and/or procedures that may arise in connection with the transaction. This page provides links for assistance with regard to the GIT/REP, Realty Transfer Fee , Controlling Interest Transfer Tax , and Bulk Sales.

Do I pay property tax when I sell my house?

On average, customers save $9,600 — more than enough to ease the burn of those transfer tax fees. Per the instructions from New Jersey Tax Guide “Buying or Selling a Home in New Jersey,”New Jersey residents who sell their homes and move out of New Jersey are considered non-residents for the purpose of the sale, Maye said. As the seller, you will have to pay a Realty Transfer fee , which is typically around 1%, Maye said. For example, if your home sells for $300,000 and your closing costs are 10% of the purchase price ($30,000), your net proceeds will be $270,000. Even if you can’t exclude all of your home sale profit, there are other scenarios where you may be able to partially lower your taxable profit. If you experienced any of the below life events, you may be able to get a partial exclusion, calculated based on the percent of the two years that you lived in the home.

Things become a bit more complex if you sell a home over $350,000. You're still expected to pay the $3.90 tax per $500 of value, up to the $350,000 mark. From there, you're taxed based on how many thousands of dollars over $350,000 your home sold for.

Better real estate agents at a better rate

He said if you have lived in the home as your primary residence in two of the last five years, you get a large tax break. For additional information, see the section on Net Gains or Income From Disposition of Property in the New Jersey Income Tax return instructions. A. The so-called exit tax causes a lot of confusion for home sellers in Jersey. For additional information, see TB-57, the Estimated Gross Income Tax Payment Requirements on Sales of New Jersey Real Property by Nonresidents . All nonresident individuals are required to check the box indicating NJ-1040NR.

A nonresident taxpayer is any taxpayer that does not meet the definition of a resident taxpayer. The form is completed and signed by the buyer, grantee, or authorized representative. The only exception occurs if the property is used as an investment or rental property, in which case the seller could deduct them as a work expense. They’ll work to get you the best deal possible, all for a low listing fee of 1%. What you save from using our service will more than cover your transfer tax fees.

If you sold an interest in a partnership, a sole proprietorship, or rental property, you may be required to use a New Jersey adjusted basis. If you sold shares in an S corporation, you must use your New Jersey adjusted basis. RTF-1 Sellers must file the Affidavit of Consideration (RTF-1) with any deed in which they claim a full or partial exemption from the RTF. The instructions to the RTF-1 list the full and partial exemptions from the RTF. “If you have a gain even after applying the exclusion, you would pay tax both at the federal and New Jersey state level,” he said. First, if you have a primary home in New Jersey for which you paid $200,000 and are selling for $275,000, you need to look at Form GIT/REP3 - Seller's Residency Certification/Exemption for New Jersey Resident Taxpayers.

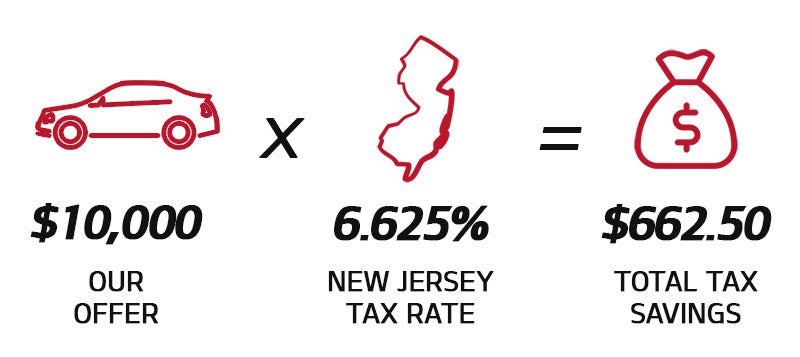

New Jersey assesses a 6.625% Sales Tax on sales of most tangible personal property, specified digital products, and certain services unless specifically exempt under New Jersey law. To do so, they must file a Nonresident Seller’s Tax Prepayment Receipt, Form GIT/REP-2, as well as the NJ 1040ES Tax Form. A New Jersey resident individual, estate, or trust is required to complete & sign the GIT/REP-3 form in order to record the deed.

It is for information purposes only, and any links provided are for the user's convenience. Please seek the services of a legal, accounting or real estate professional prior to any real estate transaction. It is not Zillow's intention to solicit or interfere with any established agency relationship you may have with a real estate professional.

No comments:

Post a Comment